Harmonic CCAP Shipments Get Underway

As predicted by the company in April, Harmonic began to ship products based on the Converged Cable Access Platform (CCAP) specifications in the second quarter of 2013, a period in which the vendor continued to see softness in traditional edge QAM sales.

“We expect growing demand for this new platform in the third, fourth quarters, and into 2014,” Harmonic president and CEO Patrick Harshman said Tuesday on the company’s second quarter earnings call. “Although we have much work still ahead of us, I believe our significant progress demonstrate both our determination and our ability to be a significant player in this evolving CCAP market.”

CCAP, a super-dense, next-gen cable access architecture, aims to combine the edge QAM and cable modem termination system (CMTS) functions. In addition to helping cable operators migrate all services to IP and support new services such as the cloud DVR, CCAP is designed to save headend space and cut down on power and cooling requirements.

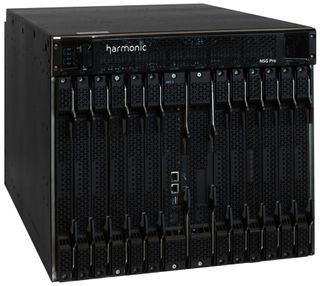

Harmonic’s first CCAP-pointing product is the NSG Pro. Under Harmonic’s roadmap, the NSG Pro is starting out as a downstream-only device that looks like a massive edge QAM. Harmonic will later tack on the routing, upstream and CMTS components to make the NSG Pro a fully integrated CCAP.

Harmonic has identified CCAP as one of its key growth areas as it competes in the sector with Arris, Cisco Systems, Casa Systems and CommScope.

As far as Harmonic’s concerned, the sooner the NSG Pro can start making hay, the better. Cable represented 36% of revenues in the first quarter, down from 44% in the year-ago quarter. “We believe those revenues will increase back to the historical range as our NSG Pro comes to market,” Harshman said.

Comcast, one of CCAP’s champions, was Harmonic’s largest customer in the second quarter, representing 11% of revenue. No other customer represented more than 10% of Harmonic’s revenue in the period.

Multichannel Newsletter

The smarter way to stay on top of the multichannel video marketplace. Sign up below.

Harmonic’s edge product line is feeling some pain, as revenues in the category declined 24.8% sequentially and 44% year-over-year, and some of that blame can be pinned on MSO anticipation of Harmonic’s new CCAP-based product.

“We believe that some of our customers are looking ahead to this new NSG Pro CCAP platform, and that has kind of put a little bit of a damper on edge sales,” Harshman said, noting that Harmonic expects those numbers to rebound later this year as the NSG Pro takes hold in the market.

Strength in video processing sales helped Harmonic offset the slump in edge sales. It posted a second quarter GAAP net loss of $3.4 million (3 cents per share) on revenues of $117.1 million, down from $122.1 million in the year ago quarter.

Wall Street analysts were expecting revenues of $108.7 million, Raymond James analyst Simon Leopold said in a research note. He expects Harmonic sales to reach $119.9 million in the third quarter.